Tax Depreciation – A review of the rules (Webinar)

This webinar will provide a review of the general tax depreciation rules. It also reviews the rules that apply to some specific assets.

This webinar will provide a review of the general tax depreciation rules. It also reviews the rules that apply to some specific assets.

The webinar will provide a detailed review of the general depreciation rules. It will identify technical issues and give practical explanations of the key tax considerations for some specific assets .

The issues/areas covered in the webinar will include the following:

- General principles

- Methods of depreciation

- Depreciation rates

- Buildings

- Residential rentals

- Commercial buildings

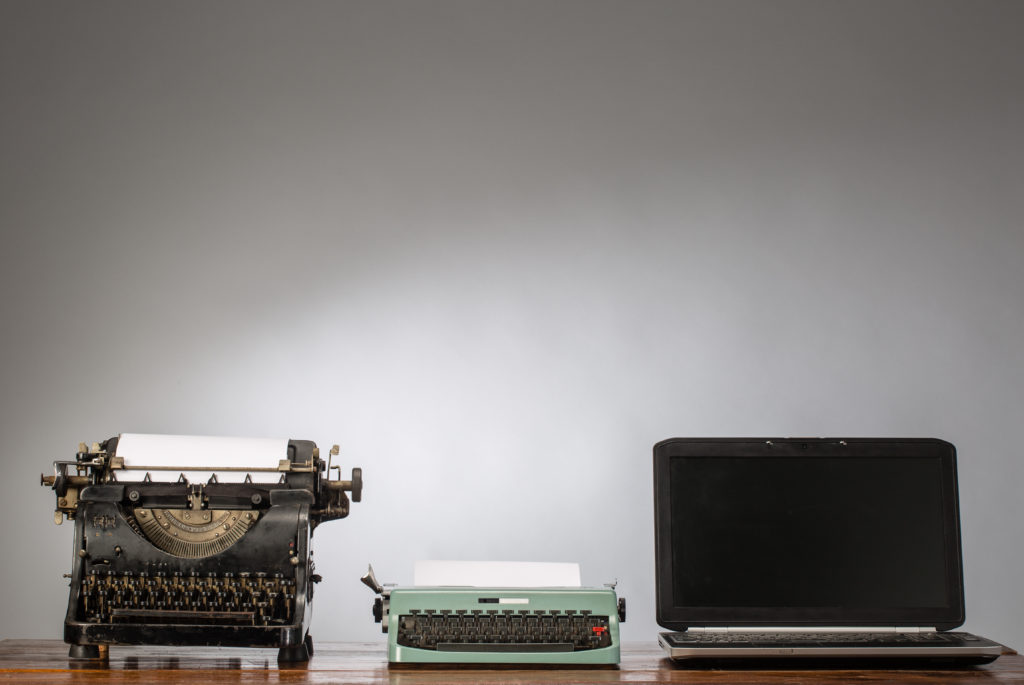

- Software

- Other specific assets

Upon satisfactory completion of this activity you will be able to:

- understand the rules and principles better

- identify relevant tax issues

- have a greater awareness of tax implications in each of the areas

Total CPD Hours: 1

Suited to:

Who should attend?

- Accounting staff and accounting technicians

- Lower level to Intermediate staff

- Anybody preparing e accounts and tax returns

PRESENTER

Mike Hadwin, Director, Symmetry Advisory

Mike is a regular presenter for TEO Training. You’ll learn from Mike’s 30-plus years of tax experience as a public CA and facilitator. His clear

presentation style enables you to quickly understand and apply practical learning concepts to common situations you may face in your role.

-

4 August 2020

10:00 am - 11:00 am

15 November 2019

15 November 2019