This webinar will be a practical review of the most relevant FA rules that are applicable to SMEs. Through detailed case studies, we will cover what’s old, what’s new and what to look out for.

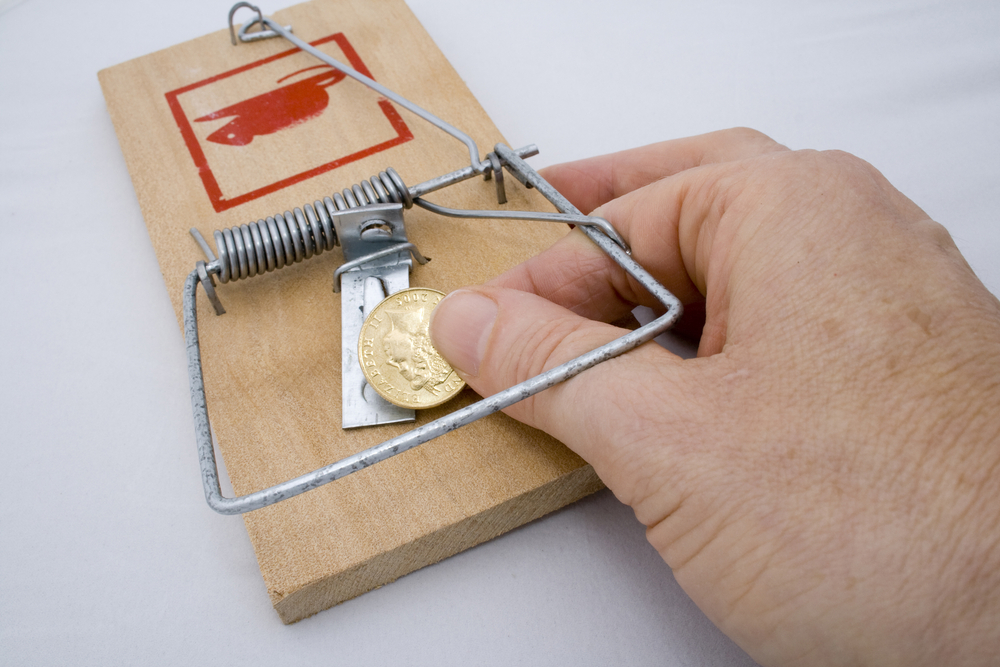

The FA regime represents one of the more unusual regimes in the NZ tax system. It can really trap you if you are not ready for it. In this webinar we will look at these rules as they apply to SMEs, using examples and walkthrough case studies.

Specific topics covered will include:

- General rules

- Overview

- What is a FA

- What is an excepted FA

- Cash basis holder

- The BPA calculation

- Deferred property settlements

- Debt remission/Bad Debts

- Finance leases

This webinar series will be a mixture of reviewing the rules and walking through worked examples

Upon satisfactory completion of this webinar you will be able to:

- Process with confidence SME financial statements and tax returns involving financial arrangements

- Advise SME clients on minimising financial arrangement tax compliance costs

- Remember the key steps and choose the best options

Suited to:

This course will be suited to foundation through to intermediate accountants, especially those in public practice and those employed by SMEs. It will also be useful for more senior accountants looking for a refresher on Financial Arrangements

Total CPD Hours: 1.5 hours (75 mins + 15 mins. Q&A)

PRESENTER

Mike Hadwin, Director, Symmetry Advisory

Mike is a regular presenter for TEO Training. You’ll learn from Mike’s 40 years of tax experience as a public CA and facilitator. His clear presentation style enables you to quickly understand and apply practical learning concepts to common situations you may face in your role.

6 December 2022

6 December 2022